Leveraging Compound Interest to Grow Your Nest Egg

A few years ago, my wife, Linnea, and I were talking about the investment account we opened for our older daughter the day she was born. I admit I check the account regularly. Linnea prefers a simple annual update.

When I sat down to show her how the account had grown, I launched into the details of each investment. Linnea stopped me mid-sentence with the question that really mattered:

“If we keep putting the same amount of money into her account each month, how much will she actually have when she’s an adult?”

It was a great question and one I had not thought about in concrete terms before.

The Power of Compounding in Real Life

I pulled out my financial planning calculator (yes, I have a calculator just for this kind of thing). Less than a minute later, I had an answer. And it blew us away.

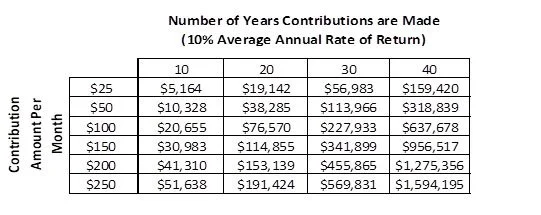

If we continue to save $250 per month, and if those dollars grow at the stock market’s long-term average return of around 10 percent annually, our daughter could have over $1.5 million by the time she reaches middle age.

That is the power of compounding interest. Most people have heard of it, but it often feels abstract or theoretical. In reality, consistent saving and time can create opportunities that seem almost impossible at first glance.

How to Get There

For many families, $250 a month (about $63 per week) is a realistic goal. If that money is invested in equity and left untouched, the growth potential can be life-changing.

If a monthly contribution feels difficult, another option is to save in lump sums. Birthdays, holidays, or other special events are often when family members give monetary gifts. Those dollars can be directed into the account, helping you reach a yearly goal of about $3,000. Some families also use a portion of a tax refund or an annual bonus to contribute.

And what if $250 per month is out of reach? What if you have more than one child or grandchild to save for? The good news is that even smaller contributions can make a meaningful impact over time.

Small Amounts Still Add Up

Here is a simple way to see it. Even $50 or $100 each month can grow into a surprising amount when given enough time. The earlier you start, the more the compounding effect works in your favor.

In sharing this story, my hope is that the conversation my wife and I stumbled upon encourages you to think about what is possible. Consistently saving, even in modest amounts, can create an incredible financial foundation for your children and grandchildren. The earlier you start, the more time compounding has to work its quiet magic.

No client or potential client should assume that any information presented or made available on or through this article should be construed as personalized financial planning or investment advice. Personalized financial planning and investment advice can only be rendered after engagement of the firm for services, execution of the required documentation, and receipt of required disclosures. Please contact the firm for further information. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Additional information about The Dala Group, LLC is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary report, which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at https://adviserinfo.sec.gov/firm/summary/291828