Does a Roth Conversion Make Sense for You?

One of the questions I am asked most often is whether Roth IRA conversions make sense. The answer is complicated, given that multiple areas of financial planning must be considered, including tax planning, retirement planning, and estate planning. To understand why this has become such a popular topic, it is important to review a quick history of Roth IRAs and Roth 401(k)s.

Roth IRAs were created in 1997, followed by the creation of Roth 401(k) plans in 2006. Given that the Roth IRA was created 23 years after the traditional IRA and the Roth 401(k) was created 28 years after the traditional 401(k) plan, most retirement savings are still allocated within traditional IRA and 401(k) plans. Prior to 2010, an individual could only convert money from a traditional IRA or 401(k) to a Roth IRA if their earned income was less than $100,000 per year. This income limit was removed in 2010, thereby allowing everyone the opportunity to complete a Roth IRA conversion. Since this change, Roth conversions have become a popular topic within the financial planning field. This article will discuss why an individual would choose to complete a Roth IRA conversion and the common pitfalls that must be considered.

What is the difference between a traditional IRA and a Roth IRA?

Traditional IRA and traditional 401(k) plans are funded using pre-tax dollars. The growth of the account is tax-deferred, and income tax is paid on withdrawals taken in the future. Any withdrawals prior to 59 ½ years old are subject to a 10% penalty from the IRS unless certain exemptions are met.

Roth IRA and Roth 401(k) plans are funded with after-tax dollars. The growth of the account is tax-free as long as the 5-year account holding period requirements are met, and then no tax is paid on withdrawals in the future. Any withdrawals of earnings prior to 59 ½ years old are subject to a 10% penalty from the IRS unless certain exemptions are met. Withdrawals of contributions are not subject to a penalty as the tax was already paid on this portion of the account.

Are Required Minimum Distributions (RMDs) applicable to traditional IRA and Roth IRA plans?

Traditional IRA and traditional 401(k) plans require that a certain amount of money be withdrawn (known as a Required Minimum Distribution or RMD) from the account each year when an individual reaches age 72. Taxes are paid on the money withdrawn based on the federal tax bracket of the account holder. The amount of the RMD is calculated by taking the balance of the account at the end of the previous year and dividing it by the account holder’s life expectancy based on the IRS tables.

Roth IRAs and Roth 401(k) plans are not subject to an RMD, so money can be left in the account to continue growing tax-free.

Why convert money from a traditional IRA to a Roth IRA?

There are typically four main reasons why an individual would choose to convert money from a Traditional IRA to a Roth IRA:

To hedge against future federal tax rate increases

To pre-pay taxes for the intended beneficiaries and provide a tax-free inheritance

To reduce future Required Minimum Distributions (RMDs) for a surviving spouse

To reduce or eliminate future federal taxes on Social Security retirement benefits

Hedge against future federal tax rate increases

For individuals who are concerned about the potential increase in federal tax rates, a Roth IRA conversion can help by allowing an individual to pay federal taxes on their IRA dollars using today’s tax brackets. By using this strategy, future federal tax rate increases will no longer influence the value of the Roth IRA account.

Pre-pay taxes for the intended beneficiaries and provide a tax-free inheritance

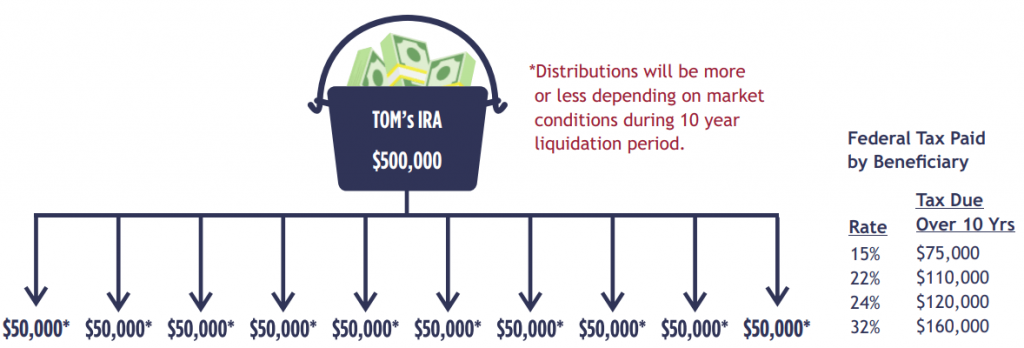

When an IRA account is inherited, the account is required to be liquidated within ten years from the owner’s death. The only exceptions to this rule are for spouses, minors, or individuals no more than ten years younger than the original account owner. This can have unintended tax consequences on the beneficiary. If a $500,000 IRA account is inherited, this will require the individual to withdraw and include it as taxable income, which will be approximately $50,000 per year. Here is an example of the taxes that will be owed by the beneficiary.

In addition to the taxes owed, the additional income can disqualify the beneficiary for certain subsidies or write-offs, eliminate their ability to make Roth IRA contributions, and influence many other benefits with Adjusted Gross Income or Modified Adjusted Gross Income limitations.

For individuals who want to eliminate these unintended tax consequences, a Roth IRA conversion may help. A Roth IRA conversion requires the owner to pay the taxes now, allowing the money to grow tax-free for the intended heirs. When the money is withdrawn by the heirs, the full value of the account will be available to them with no taxes due.

Reduce future RMD’s for a surviving spouse

For individuals who are concerned about their surviving spouses’ future RMDs, a Roth IRA conversion can help. To understand why taxes could increase upon the death of a spouse, let’s first look at the federal tax brackets for someone married filing jointly vs. filing single:

Notice that the ranges for married couples filing jointly are much more lenient than for individuals filing as single. If the annual taxable income is roughly the same before and after the death of a spouse, the surviving spouse will owe more in taxes because of the consolidation of the tax brackets. For instance, when filing jointly as a married couple, the 22% federal tax bracket doesn’t start until $80,250 per year, whereas that limit is $40,125 for an individual filing single.

Let’s look at an example of how this can affect a surviving spouse:

If Roth conversions are completed prior to a spouse's death, there will be more control over which tax bracket the money is taxed, resulting in an overall reduction in taxes paid over the lifetime of both spouses.

Reduce or eliminate future federal taxes on Social Security retirement benefits

Many individuals don’t realize that their Social Security retirement benefits will likely be counted as taxable income during retirement. The IRS uses something called “Provisional Income” to determine whether federal taxes will be owed on Social Security benefits.

Adjusted gross income includes interest, capital gains, dividends, pension income, annuity income, IRA withdrawals and any other taxable income received throughout the year. In addition, municipal bond interest and half of the household social security benefits are included as well. Once provisional income is calculated, it is then compared to the following chart to determine whether social security benefits will be taxable:

Let’s look at a married couple with provisional income of $50,000 per year. If they were collecting $3,000 per month from social security benefits, they will owe $561 per month in federal taxes. The tax owed is determined by taking $3,000 per month x 85% = $2,550. This $2,550 is then treated as taxable income on their federal tax return and taxed based on their federal tax bracket for that year. In this case, we are assuming they are in the 22% federal tax bracket so $2,550 x .22 = $561.

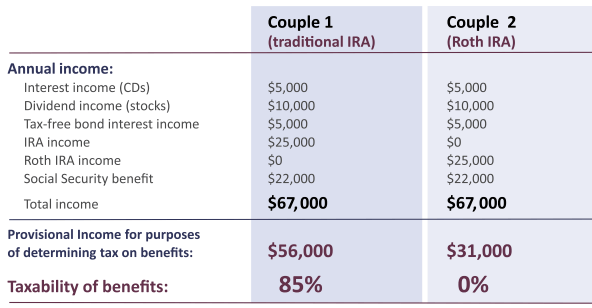

Since Roth IRA withdrawals are not included in provisional income, Roth IRA conversions prior to taking social security benefits may allow for benefits to be tax free until individuals reach age 72 when RMD’s are required. Here is an example of how this works:

The only difference between these two couples is that Couple 1 is taking $25,000 from their IRA, and Couple 2 is taking $25,000 from a Roth IRA instead. They are both living off the same income each year. Because of this difference, Couple 1 will have a provisional income of $56,000, requiring their social security benefits to be treated as taxable income. Couple 2 will have a provisional income of $31,000, allowing their benefits to be free from federal taxation.

Conclusion

There are many reasons a Roth IRA conversion can make sense, but the decision is complicated and includes multiple considerations, including tax consequences, projected cash flow, and the intended goals for future beneficiaries. If you need help determining whether Roth IRA conversions make sense given your financial goals, please schedule a time for us to discuss.

No client or potential client should assume that any information presented or made available on or through this article should be construed as personalized financial planning or investment advice. Personalized financial planning and investment advice can only be rendered after engagement of the firm for services, execution of the required documentation, and receipt of required disclosures. Please contact the firm for further information. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Additional information about The Dala Group, LLC is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary report, which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at https://adviserinfo.sec.gov/firm/summary/291828