Learning to File & Understand Your Tax Return

It’s tax time again!

I have a love-hate relationship with filing taxes. On the one hand, I like the feeling of accomplishment and sometimes getting a refund (but not too much), but the process of collecting documents, picking how to file, and completing the filing seems arduous. I usually carve out time in late January and early February to pull together the documents and aim to get my return filed by the end of March. If you’re just getting started, you may be feeling overwhelmed. If you’re interested in filing yourself, I hope this article gives you an understanding of what each part of the 1040 form means.

For a visual guide, watch Mike Heatwole, CFP®, walk you through each section of the Form 1040, highlighting common mistakes and tax planning opportunities.

Get Your Ducks in a Row

Before you start filling out forms, gather all your documents. Ensure you have all the tax reporting forms from your bank and investment accounts. Any account The Dala Group manages is set for you to receive a paper copy. Your client portal is where you can see your complete financial picture and help remind yourself of all the sources of taxable income. Don’t forget to collect the receipts from any charitable gifts you’ve made this year, or grab your mortgage interest and property tax payment reporting forms. The last way we help you prepare is by sending you a tax letter each year detailing the taxable events associated with the wealth management strategies we helped you execute, so make sure you are on the lookout for that.

Filing DIY or with a Pro

Armed with this information, you’re ready to determine how to file. I don’t suggest paper these days! You can file electronically through one of the well-known 3rd party sites or connect with a professional tax preparer. Pick the option that makes the most sense for you. Filing yourself is a great option if you have a straightforward tax picture and are confident. But don’t underestimate the value of hiring a tax pro, especially if you have a complex situation like business ownership or executive compensation. We have contacts in our network to whom we can refer you.

PSA for tax preparers: Don’t wait until the last minute to get your information to them. They have an unbelievably demanding filing season, and if you give them the information they request and ample time to prepare and file your return, that will be one less fire they need to douse!

Whether you DIY it or use a pro, I think understanding your tax return empowers you in your finances, so I want to spend time teaching you about the primary 1040 form and related concepts.

The Big Daddy Form

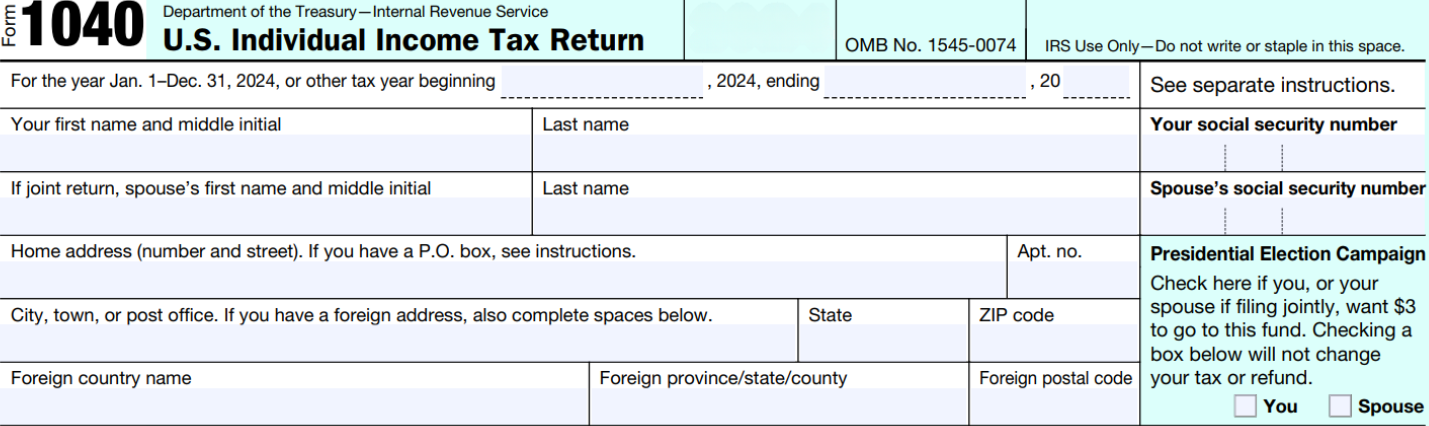

Form 1040, the US Individual Income Tax Form, is the one you’re looking for. I will break that form into seven subdivisions:

Information About You

Income You Made

Deductions You Can Take

Taxes You Owe

Credits Applied to Your Bill

Payments You’ve Made

Refund Due or Balance Owed

Info About You

This top section of the form is where you tell Uncle Sam who you are, where you live, the status you will use for filing (more on that in a second), and the makeup of your dependents. The first several lines are straightforward, where you give all your basic vitals. Getting your Social Security number right is important so they know who to tie all the income and tax information to.

When you reach the filing status section, you have a choice of single, married filing jointly, head of household, and a couple of less common options. This section dictates several items later in your return, such as deductions, the tax percentage you pay on certain portions of your income, and whether you qualify for certain credits, so it’s important to get this right.

The Standard Deduction area is especially important for older retirees or those with blindness because picking the appropriate boxes here increases the amount you can deduct from your income, so don’t miss these questions.

Finally, you will list all of your dependents. Typically, these are children living in your home who are still attending school. Watch out that you choose the correct type of dependent. When my son turned 17, I forgot to account for the fact that he no longer qualified for the Child tax credit, and thus, I had to pick ‘Credit for other dependents’ instead and take a smaller credit. That wasn’t a fun tax bill to pay in 2022.

The nice thing about tax filing software is that it takes you through an interview process that leads to supplying all of the above information and picking the right choice for your situation if it’s not obvious. Your tax preparer will likely ask you to fill out an information sheet they will use to complete this top portion.

Income You Made

This is the section with all of the meat and potatoes. Each line (1-8) holds a place for a different kind of income. Line 1 is broken up into several sub-items, but most commonly, you will put the total amount from all of your family’s W2 forms in box 1a. What is unique about 1a – z is that it represents earned income, which is subject to Social Security and Medicare (FICA) tax.

We use lines 2 – 8 to report investment income that isn’t subject to FICA. You’ll receive a 1099 form of some type from each institution associated with your IRA distributions, pension payments, dividends, interest, social security, and money from the sale of assets that went up in value, and you’ll put the sum of those payments in the corresponding boxes. Qualified dividends (3a) are super cool because you are taxed differently on that type of income, highlighting the value of the tax planning service you receive as one of our wealth management clients. We identify ways to take advantage of your qualified earnings. For those of you collecting Social Security, lines 6a & 6b have unique significance because they show how much of your benefit is taxable. Those two lines should never be the same amount because a maximum of 85% of your benefit is subject to tax.

Total all the taxable amounts from lines 1 - 8 and put it on line 9.

Deductions You Can Take

You may find this interesting. You don’t pay tax on all of the money you earn! Yeah, Uncle Sam is “reasonable” like that. Two lines are coming up that matter most – line 11, your adjusted gross income (the cool kids call it AGI), and taxable income on line 15.

Follow the Train to AGI

Before you can get to your adjusted gross income (AGI), you must figure out all the “above the line” deductions you can take. Above the line is a colloquial term for all the unique things you get to remove off the top from your total income. Things like educator expenses, health savings account (HSA) contributions (if not already deducted from your paycheck), some self-employment tax, student loan interest, traditional individual retirement account contributions, and many more.

Sidebar #1: The IRS has made our lives both detailed and complicated by the use of schedules. Schedule 1 impacts AGI. All schedules (2, 3, B, C, D, E, SE) are special worksheets to track and report income, deductions, extra taxes, and special cases from transposition onto the less detailed form 1040.

Tax law uses AGI as the qualifier for numerous tax benefits like IRA contributions, student loan interest deductions, and the child tax credit. That’s why we have a special line with bolded characters so that it sticks out like a lightly bruised thumb. It’s also the income number used as the starting place on your state income tax return. Super important.

Sidebar #2: There’s another thing called MAGI (not the wise men) that also plays a role, but I have a word limit here, so I’ll have to skip this nice tax law curveball this time.

Once you have all your “above the line” adjustments calculated (line 10), subtract that from the total income you recorded on line 9 to arrive at your AGI for line 11. Are your eyes rolling in your head yet?

Are We There Yet?

We aren’t. We don’t calculate how much income tax is due until we get to taxable income on line 15, and before we get to that number, there are two more items to subtract, thankfully. We have a deduction on line 12, which, in layman's terms, is called the “below the line” deduction. This comes in two forms: the standard deduction or an itemized deduction. You get to take the higher of either of them.

Most of us will take the standard deduction due to the Tax Cuts and Jobs Act of 2017 because Congress significantly raised the standard deduction. Some will try to sell you on a mortgage because of the “tax benefits” from deducting mortgage interest. That’s bunkum because the standard deduction is so high, and going into debt just to save a relatively minute amount on taxes is bad math.

If you’re VERY charitably minded or had a boatload of out-of-pocket medical expenses (among other things) on top of property and state taxes and mortgage interest, the itemized deduction could be more advantageous. This is where keeping detailed records of relevant expenses will help the software you use or the accountant you choose determine which is better. (Bonus help from the IRS! They print the standard deduction for each filing type along the left-hand side of the 1040, so it’s easy to know what to enter.)

Sidebar #3: The second deduction (line 13) for those of us who run a business is called the Qualified Business Income (QBI) deduction, but I have a word limit here, so we’ll have to save that for another day.

Now add your “below the line” (line 12) and QBI deduction (line 13) and subtract that from your AGI, and voila, you have your taxable income for line 15.

Taxes You Owe

From your taxable income, you’ll have a specific tax amount due on line 16. Trust me, you don’t want to figure this amount by hand. (Mike made me do that in a case study to see how well I knew my tax facts). Trust the software or your accountant to get the right number, but I want you to have more information on this calculation. To keep it simple, we have a graduated income tax structure. That means the first bit of your taxable income has a lower rate applied than the last dollars you earned. These are called marginal tax brackets, and they adjust up every year to account for inflation. That’s good news because you don’t pay the higher rate on all your income, only the amount that falls in the higher bracket. We calculate the bill owed in each bracket segment, add them up, and put that number on line 16.

But wait, there’s more. Just like we had several subtractions when figuring out our AGI and taxable income, we have taxes we might need to add from Schedule 2. Yay! The most common one I see is the healthcare marketplace premium credit repayment. We include checking and adjusting this credit as part of our wealth management service to reduce any end-of-the-year surprises. Add those two tax lines and put the final amount owed on line 18.

Credits Applied To Your Bill

Wait, I said the final tax amount just a millisecond ago. Well, actually, that’s not true because we might qualify for credits, and that’s a good thing! Credits are different than deductions. The deductions you claimed above reduce the amount of your income subject to tax, whereas credits reduce, dollar for dollar, the taxes you owe. Deductions are like paying a lower price on an open-box item, causing you to pay less sales tax, and a credit is like having a discount applied to your final bill, so you pay less at the bottom of the receipt after everything was totaled up.

The most well-known credit is the Child Tax Credit, available for qualifying children and other dependents. The form separates certain credits to make calculations easier. Check out Schedule 3 to see which credits are available each year. Add up all applicable credits and subtract them from your total tax owed to determine the final amount due.

This is a head-scratcher, I admit, but now, on line 23, you have to add in some ancillary taxes! These additions are back on Schedule 2 and include self-employment taxes, additional Medicare taxes, and the net investment income tax. Add that to line 22, and FINALLY, we come to the end of your purchase, your total tax on line 24.

Payments You’ve Made

So how do you pay for all that? Luckily, your employer has held back income from your bank account and sent that on to the Department of the Treasury on your behalf, which you can see on the W2 forms you were sent and report on line 25a. Other entities (banks, investment companies, pension plans, and the like) have done the same from the income they gave you and reported that to the IRS on the various form 1099s (line 25b) you collected. Add all those payments so graciously held back for you and put the total on line 25d.

You may have a situation where no one is holding back taxes for you, so you must take care of that yourself. The most common reason is that you are self-employed, so you must make estimated payments (line 26). In that case, make them quarterly based on the net income you earned by the quarterly due date. Paying 25% of net income is a starting place for figuring out what to send. And if you don’t pay by the quarterly due dates, penalties and interest may apply.

We help all of our self-employed business owners figure out how much they need to pay each quarter so they don’t get behind and feel sick when they see the large bill they must pay. That is another standard part of our wealth management services.

Total up your payments and put that on line 33

Refund Due Or Balance Owed

Now, the moment of truth. How close did you come to paying your bill? The text on line 34 says it all. If you have paid more (line 33) than you owed (line 24), you get money back as a refund, and enter that right next to where it says in big, bold letters “overpaid.”

You might be like a lot of folks I talk to and like to get a big refund. You might already have plans for how to spend that in December or January each year. Just remember, if you get a lot back, it isn’t a gift. It simply means you paid too much to the government, and now they are giving your money back, with no interest, I might add. This brings up another service we provide to all of our wealth management clients: a tax withholding analysis. In that, we look at your entire financial picture and aim to get you as close to $0 refunded or owed. Getting a smaller refund means you will have more money in your bank account each pay period. I like that!

The other possibility is that you didn’t pay enough and owe. That sad fact is reported on line 37 next to the words in big, bold letters: “amount you owe.” I’ve seen some big numbers here, and that’s another reason we offer to analyze your withholdings. We don’t want any sad faces when you see that final number.

This year, my line 37 showed I underpaid by $205, but I will receive a $500 refund from the state, so I call that a win in the tax planning game. That outcome was a result of paying attention throughout the year and making a couple of estimated payments. So, there you have it, the end of your return.

We’re Here to Help You Get Filing Right

If you want someone on your financial team who can take the burden of figuring out how to have a similar outcome, The Dala Group is here to serve you. We offer immense value to our clients in the way of tax planning. All tax services are included in our wealth management fee. If you’re an existing client and haven’t taken advantage of these services, upload your return today. We’ll produce a tax report summarizing your return and recommendations for corrections or recommended tax-saving strategies. If you’re not a client and you’re interested in discussing how we can help you plan for taxes, schedule an intro call with us.

No client or potential client should assume that any information presented or made available on or through this article should be construed as personalized financial planning or investment advice. Personalized financial planning and investment advice can only be rendered after engagement of the firm for services, execution of the required documentation, and receipt of required disclosures. Please contact the firm for further information. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Additional information about The Dala Group, LLC is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary report, which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at https://adviserinfo.sec.gov/firm/summary/291828