Evaluating Funds for Your Portfolio: How to Choose Mutual Funds

The vast majority of your wealth will not be earned by the funds you pick. That’s where I want to start, so I’m setting the stage for what IS the most important. Having said that, I enjoy research and analysis of Mutual Funds and thought you might, too, if you were armed with some tools and foundation. Not all funds are suitable, and it can be overwhelming because there are hundreds to choose from. Your investigation could be the starting place before a larger conversation with your financial advisor.

What is Most Important?

Your wealth-building will come hands-down from you employing a systematic method of investing consistently for the long haul, not the Mutual Fund you pick. That takes dedication and may mean you sacrifice your spending today to reach tomorrow’s goal. If you want to save $1,000,000 by the time you retire, you’ll need to invest these amounts monthly.

Time and rate of return make the monumental difference. The first moral of the story is start investing ASAP to take advantage of the 8th wonder of the world*: compound growth. You’re ready when you’ve at least eliminated high-interest debt and have a full emergency fund. The second moral is that to build your nest egg, you need an investment type that has the potential to maximize returns with the least long-term risk, and that means choosing equities (aka stock) for long-term investing. For example, the S&P 500 Index, which tracks the value of the 500 largest US companies, has averaged a 12% rate of return from 1926 to 2023, and over 96% of 10-year periods have produced positive returns**. Debt instruments like bonds, money market funds, and CDs, while considered “safe,” historically underperform the stock market and return in the neighborhood of 6%**.

Starting Foundation

So, why not hold a bunch of stocks in your investment account? The simple truth is that it takes tremendous time, effort, and expertise to analyze individual companies. Plus, you don’t want all your proverbial eggs in one or only a handful of companies. You want your investment spread across companies of all shapes and sizes and in various industries and locations. That’s diversification. These are two reasons why mutual funds are wonderful (ETFs fit here, too).

It’s important to burn into your mind two other principles.

You’re not trying to beat the investment performance of your neighbor. You’re trying to beat the eroding nature of inflation and reach your wealth-building goal.

Be a long-term investor and avoid chasing performance. Switching funds for the latest hot performer can lead to serious underperformance because you’re inherently selling your apparent underperformer low and buying the perceived winner high.

Hunting Tools

It’s tough to whittle down the universe of funds without an effective tool. Quality hunting tools have built-in filters that allow you to select the multitude of fund attributes discussed below. Play around with the filters in the tool you choose to get a feel for what the different selections do. On the left is an example of the fund filters you want available.

You might need to use more than one tool to find all the traits I mention below. For example, the Fidelity Mutual Fund selector shown above is missing a couple of the attributes you can find in Morningstar’s free fund ratings.

Characteristics to Ignore

I don’t include analyst ratings from companies like Morningstar and FactSet or the picks highlighted by the tools I use. Call me crazy for thinking ratings and recommendations could have sponsorship biases.

Who Wants to Pay Transaction Fees?

Fund platforms like Schwab, Fidelity, and Vanguard offer a vast universe of funds, not just ones they manage. Some Mutual Funds have a transaction fee or sales charge associated with them. One fund might be fee-free on one platform but not the other. You can set your filter to include or exclude funds with these fees.

A Word About Active Management

The criteria below are geared toward those who want to find funds that beat their benchmark stock indexes, like the S&P 500, through active management. An active fund manager dynamically selects investments based on strategy and market research, monitoring performance and adjusting along the way.

Elements for Consideration

Fund Type & Objective

To be diversified, you’ll want to select funds including various US company sizes & international stocks: Large-cap, mid-cap, small-cap, and international. As you search, focus on one fund type/style at a time and aim to find three options in each type before making a final selection. If you see a World fund, it isn’t the international fund you’re looking for because it will include more US companies. Pay attention to the fund’s objective, too. Capital appreciation means the fund manager wants stocks with growth potential. Value or income means they want consistent dividends.

Fund Inception

You want to find funds with a long track record so you have ample information to examine. Try setting your filter for funds with an inception date of 10 years or more.

Manager Tenure

If you’ve gone the Active Management route, a manager with 5 years or more experience can be reassuring, especially if you pair that with fund performance. Most managers don’t outperform their index, but a fund attribute called alpha tells you whether they generate excess returns in comparison to the fund’s benchmark index based on the risk they are taking. Any positive number over a long period of time indicates that the manager did better than the index.

Expenses

The fees charged by the fund for management and expenses reduce the returns you realize, so naturally, the lower the fee, the more of the underlying returns you participate in. Start with a net expense filter of less than 1% and maybe as low as 0.5%.

Turnover Rate

This represents the percentage of holdings sold annually. A lower turnover rate means the manager holds more of the investments for the long term. That could indicate the manager isn’t trying to time the market and is confident in their investment methodology. Start with your turnover filter set to 25% and less, and go from there.

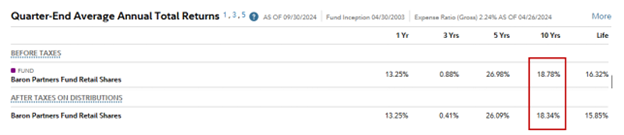

Tax Cost

Every fund has some sort of annual or quarterly distribution that produces income or realized capital gain in your investment account. In a retirement account, that’s not a big deal because those accounts are sheltered from taxes. However, if you are selecting a fund for a taxable investment account, you’ll pay taxes on the distribution. So, tax cost has greater or less importance depending on the location. You can tell a fund has a big tax cost by comparing the Total Returns Before Taxes and After Taxes on Distributions. The bigger the spread, the bigger the tax burden.

Example of High Tax Cost

Example of Low Tax Cost

Holdings

If you have a fund with a bajillion holdings and are paying for active management, you might as well own an index fund and be done with it. Also, when the top 10 holdings in a fund comprise an overly large share by percentage, that can indicate you are exposed to concentration risk, meaning if those top holdings fall, the fund is affected to a greater degree than if the holdings had more balance.

Performance

Of course, performance matters! Why would I want a laggard? Remember, though, that neither past nor recent performance predicts future returns. It can be tempting to jump to a fund that has performed well recently when another one has been lagging. It’s important to study the variability of returns over at least 10 years and the full life of the fund and make a judgement call.

What I just described is some of the work we do for our wealth management clients. We make sure clients are diversified and manage the hunting and selection for you so you have peace of mind that you’re invested suitably to reach your long-term goal in a tax-optimized way. And when it’s time to start withdrawing from this nest egg you’ve amassed, we’re there to construct an optimal distribution strategy to fund the rest of your life and leave a legacy for your family.

*Attributable to Albert Einstein

**Nick Murray. Simple Wealth, Inevitable Wealth. Nick Murray Company, 2009.

No client or potential client should assume that any information presented or made available on or through this article should be construed as personalized financial planning or investment advice. Personalized financial planning and investment advice can only be rendered after engagement of the firm for services, execution of the required documentation, and receipt of required disclosures. Please contact the firm for further information. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Additional information about The Dala Group, LLC is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary report, which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at https://adviserinfo.sec.gov/firm/summary/291828